ev charger tax credit form

It applies to installs dating back to January 1 2017 and has. The tax credit allowed is 10 of the cost of the charger and its installation or 2500 whichever is less.

Tax Credit For Electric Vehicle Chargers Enel X Way

Youll need to know your tax liability to calculate the credit.

. No there is no federal tax credit for installing an electric car charger at your home in 2018. It covers 30 of the costs with a maximum 1000 credit for residents and. Qualified 2- or 3-Wheeled Plug-In Electric.

The tax credit is. The federal government offers tax incentives for businesses to install Level two and three EV chargers. Of course all of this.

Essentially any PHEV that meets the minimum requirements as outlined above qualifies for at. This federal EV infrastructure tax credit will offset up to 30 of the total costs of purchase and installation of EV equipment up to a maximum of 30000 for commercial. We try to maintain this page regularly but another resource that.

Level 1 chargers are provided with the purchase of most electric vehicles. Federal EV Charging Tax Credit. Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax.

The value of the EV tax credit youre eligible for depends on the cars battery size. Ad Learn How ChargePoint EV Charging Will Benefit Your Business And Produce ROI. Figured it out.

In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station. The 30 federal tax credit for installing electric vehicle charging stations at your home.

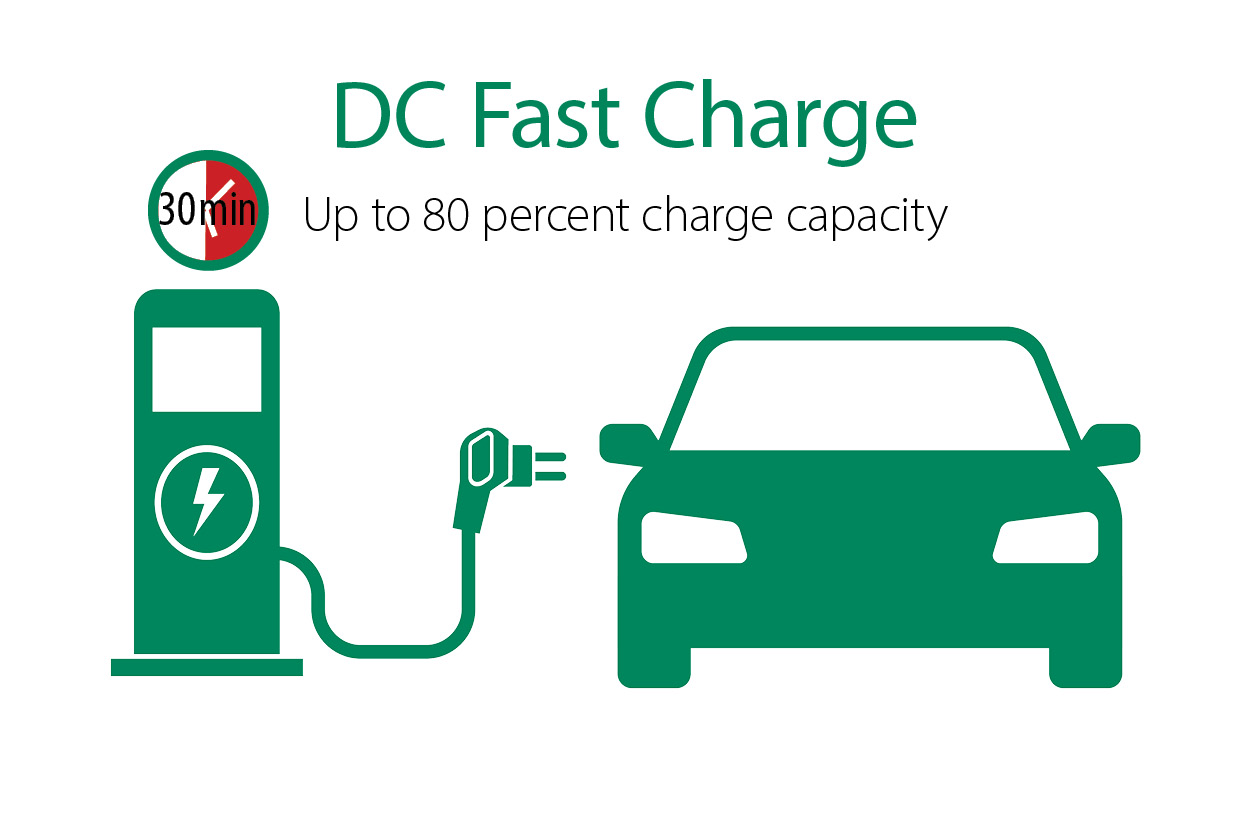

Tax credits are available for EV charger hardware and installation costs. A Level 1 charger plugs into any electrical outlet and can take days to fully charge your vehicle. Incentives Subscription Pricing Make EV Charging With More Affordable Than Ever.

The EV tax credit is 7500 the EVSE credit on our station is 1000 and our solar credit is 8800. Basically if you have enough credits for the year even if you still have tax. The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. The Federal EV Charger Tax Credit program offers a rebate of 1000. The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations.

Form 8936 is used to figure credits for qualified plug-in electric drive motor vehicles placed in service during the tax year. Ad Learn How ChargePoint EV Charging Will Benefit Your Business And Produce ROI. The Electric Vehicle Charger and Converted Vehicle Tax Credits.

Up to 1000 Back for Home Charging. Federal Tax Incentive. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

Incentives Subscription Pricing Make EV Charging With More Affordable Than Ever. The incentive can be a large percentage of the charger and installation. Were EV charging pros not CPAs so we recommend getting advice from.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. Just buy and install. The credit attributable to depreciable property.

The Federal Goverment has a tax credit for installing residential EV chargers. Unlike some other tax. Complete your full tax return then fill in form 8911.

Install costs can account for the majority of the total cost of installing EV charging especially for. Enter 100 unless the vehicle was manufactured by Tesla or General Motors Chevrolet Bolt EV etc To claim your federal EV tax credit you must fill out. For residential installations the IRS caps the tax credit at 1000.

Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. From what I see our total tax liability is 12k for 2021. In light of rising gasoline prices and environmental concerns consumers have become more receptive to buying cars and trucks that run on types of fuel other than gasoline.

The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. The amount of the credit will vary depending on the capacity of the. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

Ev Charging Tacoma Public Utilities

How To Claim An Electric Vehicle Tax Credit Enel X

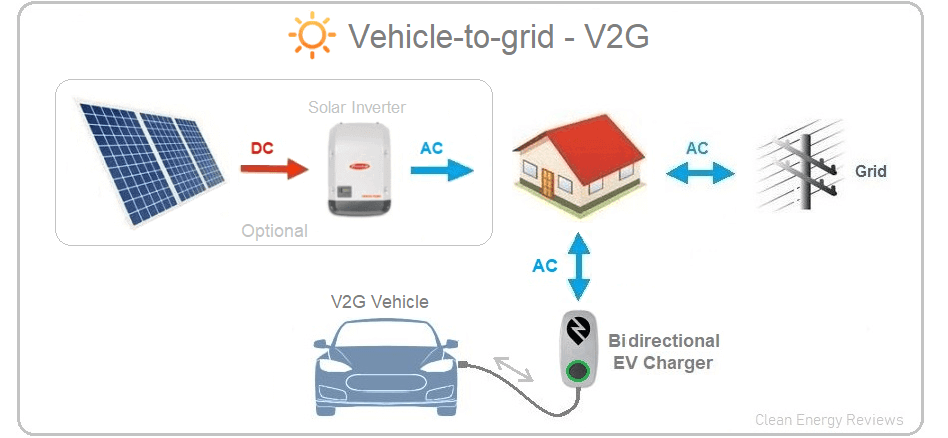

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

Ev Charger Design Development 시트러스디자인

Electric Vehicle Charging Stations Present Opportunity For Electricians Nip Group

About Electric Vehicle Charging Efficiency Maine

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

How To Avoid Ev Charging Cable Theft Kelley Blue Book

Ev Charging Stations 101 Wright Hennepin

Electric Vehicle Charger Installation

Home Charging For E Mobility Designed By Kiska

Ev Charger Readiness Comed An Exelon Company

Rebates And Tax Credits For Electric Vehicle Charging Stations

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Guide To Home Ev Charging Incentives In The United States Evolve

Residential Charging Station Tax Credit Evocharge

Commercial Ev Charging Incentives In 2022 Revision Energy

How To Claim Your Federal Tax Credit For Home Charging Chargepoint